U.S. Import Duties Rates Explained

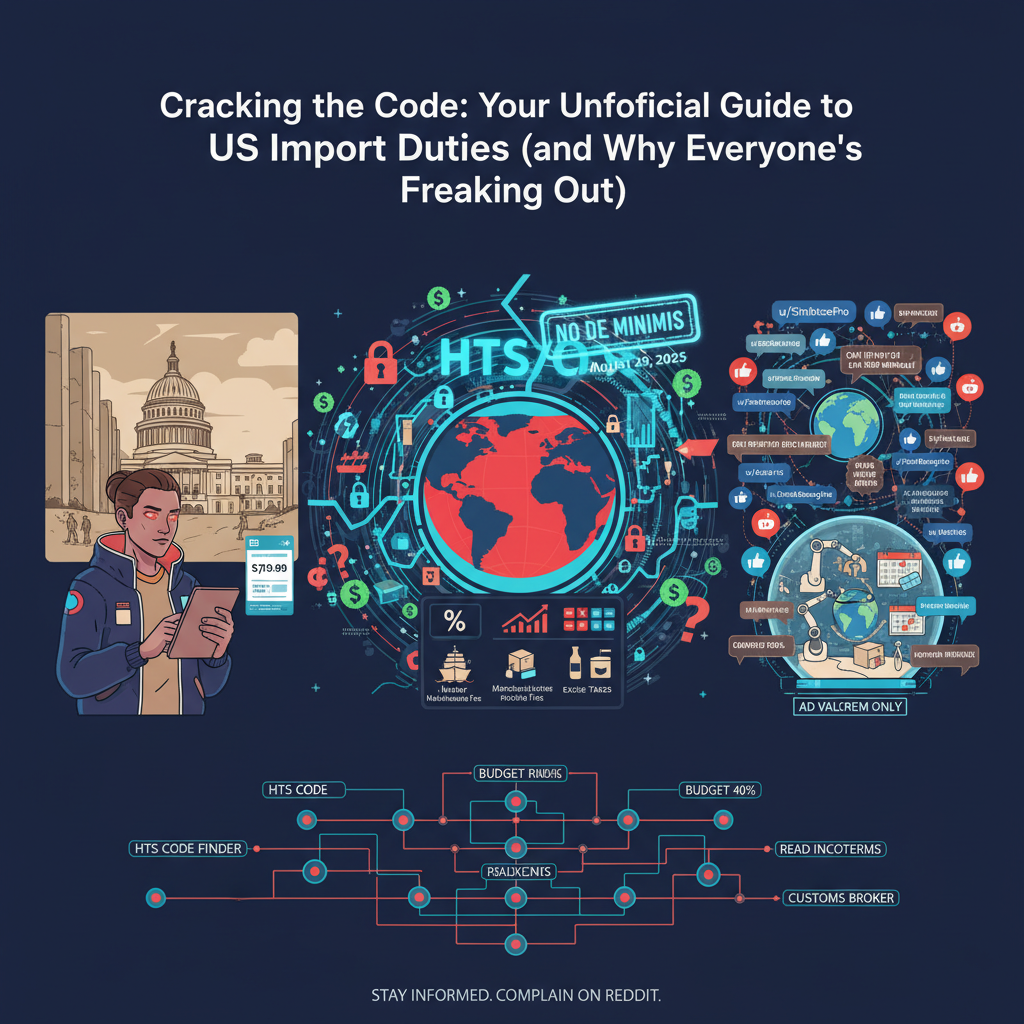

Ever spotted the perfect item on an international website and hesitated to click “Buy” because you weren’t sure how much customs would add on top? You’re not alone. Importing goods into the U.S. has become increasingly complex due to evolving trade laws, tariff adjustments, and new compliance regulations.

In this comprehensive guide, we’ll break down the real meaning of import duties, the new rules affecting online shoppers and small businesses, and how to calculate your total landed cost accurately — without any confusing jargon.

Table Of Content

1. Understanding U.S. Import Duties: Why It Matters More Than Ever

Ever spotted the perfect item on an international website and hesitated to click “Buy” because you weren’t sure how much customs would add on top? You’re not alone. Importing goods into the U.S. has become increasingly complex due to evolving trade laws, tariff adjustments, and new compliance regulations.

In this comprehensive guide, we’ll break down the real meaning of import duties, the new rules affecting online shoppers and small businesses, and how to calculate your total landed cost accurately — without any confusing jargon.

2. What Exactly Is an Import Duty?

Import duty (or tariff) is a tax imposed by the U.S. government on goods entering the country. It serves two main purposes:

- Revenue generation for federal programs.

- Protection of domestic industries by discouraging foreign competition.

However, in reality, these duties often create additional costs that impact importers, retailers, and consumers.

3. The Building Blocks of Import Duty Calculation

HTS Codes: The Foundation of U.S. Tariffs

The Harmonized Tariff Schedule (HTS) is the U.S. classification system used to determine the correct duty rate. Every product has a unique 10-digit HTS code — for instance, 9506.91.0030 for exercise equipment.

Using the wrong code can lead to:

- Higher tariff rates.

- Delayed customs clearance.

- Potential penalties from U.S. Customs and Border Protection (CBP).

✅ Tip: Use tools like tariffdutycalculator.com or the U.S. International Trade Commission (USITC) database to find the correct HTS code for your product.

4. How Duties Are Calculated

Most duties are calculated as a percentage of the product’s customs value, also called the CIF value (Cost + Insurance + Freight).

Some exceptions apply when flat-rate tariffs or specific rates (per quantity or weight) are used.

Formula:Import Duty = CIF Value × Duty Rate

Example:

If you import electronics worth $2,000 with a 5% duty rate, your import duty is $100.

5. The Hidden Charges Few People Expect

Merchandise Processing Fee (MPF)

Charged on most imports, typically 0.3464% of the customs value (minimum and maximum limits apply).

Harbor Maintenance Fee (HMF)

Applies only to ocean freight imports — 0.125% of the shipment’s value.

Excise Taxes

Applied on specific products like alcohol, tobacco, and certain fuels.

Special Tariffs (Section 301, Section 232, etc.)

Additional duties may be imposed on certain countries or industries for economic or political reasons. These can change rapidly, impacting thousands of importers overnight.

6. A Quick Look Back: The History of U.S. Tariffs

Tariffs have shaped U.S. trade policy for over a century. The infamous Smoot-Hawley Act of 1930, which raised global tariffs by 20%, contributed to the Great Depression by reducing international trade.

History reminds us that protectionist policies often trigger chain reactions — driving up costs for consumers and stifling global commerce.

7. The End of the $800 Duty-Free Threshold: A New Era for Importers

For years, goods valued at $800 or less could enter the U.S. duty-free under the de minimis exemption. This policy simplified small-scale imports and benefited online shoppers and e-commerce sellers.

But as of August 29, 2025, that exemption has been eliminated.

⚠️ What This Means:

- Nearly all shipments, regardless of value, now require formal customs documentation.

- Every importer — from individuals to small businesses — must be prepared to declare product value and classification accurately.

- Expect higher administrative costs and longer processing times at ports of entry.

This shift has created challenges for micro-importers, small e-commerce brands, and individual buyers, who must now account for duties even on low-cost items.

8. Who Really Pays for Import Duties?

While tariffs are imposed on imported goods, the real financial burden falls on importers and consumers — not foreign manufacturers.

When duty rates rise, importers pass those costs to retailers, who in turn increase prices for consumers.

In practical terms:

- A 10% tariff increase on imported materials can translate into a 15–25% retail price hike once logistics and taxes are factored in.

- Businesses importing niche goods (like automotive parts or hobby equipment) are especially vulnerable to cost surges.

9. Why the Current System Feels Confusing

Between changing tariff rates, overlapping trade policies, and inconsistent carrier fees, importers often describe the current landscape as uncertain and unpredictable.

Key frustrations include:

- Frequent regulation changes without clear guidance.

- Variable interpretations by different customs brokers.

- Hidden handling fees added by couriers such as FedEx, UPS, and DHL.

This uncertainty has made it harder for small businesses to forecast costs and manage cash flow effectively.

10. The Small Business Impact: When Paperwork Meets Profit Margins

Small e-commerce sellers — particularly those operating on global platforms — face increasing challenges:

- Complex Documentation: Even under trade agreements like USMCA, proof-of-origin paperwork can delay clearance.

- Higher Return Rates: Many U.S. buyers now reject deliveries when unexpected duties appear.

- Profit Margin Erosion: Added fees make imported goods less competitive.

As a result, many small sellers are shifting strategies, focusing on domestic suppliers or using third-party logistics providers with integrated customs solutions.

11. The Rising Role of Shipping Carriers

Major carriers play a crucial role in customs processing, but inconsistencies abound:

- Some carriers process all shipments as formal entries (even when not required), leading to unnecessary fees.

- “Advance payment” charges are often added automatically.

- Lack of transparency in how duties are calculated can make it difficult to verify accuracy.

Importers are increasingly turning to self-clearance options through CBP to minimize costs and gain control over declarations.

12. The Bigger Picture: Economic and Trade Implications

Experts warn that sweeping tariff policies and reduced trade exemptions could:

- Increase supply chain bottlenecks due to more inspections.

- Slow cross-border trade as smaller sellers withdraw from U.S. markets.

- Encourage regional trade networks that exclude the U.S., isolating it from emerging global alliances.

These shifts could reshape international commerce, particularly in sectors like electronics, fashion, furniture, and automotive components.

13. How to Navigate Import Duties Like a Pro

a. Master the HTS Code System

Identify your product’s correct classification using official databases or tariff calculators.

b. Budget for Total Landed Cost

Always include potential duties, taxes, and carrier fees in your pricing model. A safe rule of thumb is to budget 20–30% above product cost.

c. Understand Incoterms

Know whether your shipment is Delivered Duty Paid (DDP) or Delivered Duty Unpaid (DDU) — this determines who pays what at customs.

d. Consider a Licensed Customs Broker

Brokers can help ensure compliance, minimize delays, and even find exemptions or refund programs.

e. Keep Every Receipt and Invoice

Proof of value helps avoid overcharging and simplifies appeals if customs miscalculates your duty.

f. Monitor Policy Updates

Tariff rules change frequently. Subscribe to trade bulletins or follow resources like U.S. Customs and Border Protection (CBP) and tariffdutycalculator.com for updates.

14. Final Thoughts

The world of U.S. import duties has shifted dramatically in 2025. With the de minimis threshold removed, increased inspections, and new trade enforcement measures, the landscape has never been more complex.

However, with the right knowledge and preparation, importers can still thrive. By mastering tariff classification, budgeting for full landed cost, and staying informed, you can protect your business from surprises and maintain a competitive edge in global trade.

For instant estimates and compliance support, explore tariffdutycalculator.com — your companion for navigating the modern world of import duties.

15. FAQ

Q1. How are import duties calculated in the U.S.?

Duties are based on the product’s CIF value and its assigned HTS code duty rate.

Q2. Do shipping costs count toward duty calculations?

Yes — most duties include freight and insurance when calculating customs value.

Q3: What is CIF value?

It stands for Cost + Insurance + Freight, forming the basis for customs valuation.

Q4. How do I avoid excessive import duties?

Use accurate HS codes, explore trade agreements, and check if your goods qualify for duty exemptions.

Q5. What happens if duties are unpaid?

Customs may hold or return your shipment, and repeated issues can result in penalties.